Gainful

Get a straightforward, fast service on-the-go. One document is all you need

Get a straightforward, fast service on-the-go. One document is all you need

A direct lender committed to responsibility and innovation. We keep your data confidential and help in hard times

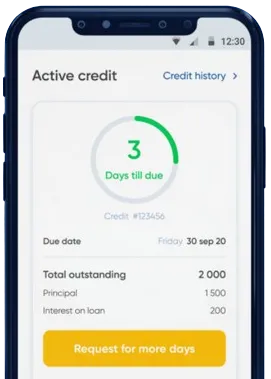

Easy and quick solutions without leaving home. Money is instantly transferred, with loan extension options

Enter your application details in the app by filling out the form.

Stand by for our decision, usually delivered in just 15 minutes.

Have the money transferred to you, usually within one minute.

Enter your application details in the app by filling out the form.

Download loan app

Same day payout loans in South Africa have become increasingly popular as they offer a quick and convenient solution to financial emergencies. These loans are designed to provide fast access to cash, usually within 24 hours of application approval.

One of the main advantages of same day payout loans is the speed at which funds are made available. This can be crucial in emergency situations where immediate access to cash is needed. With these loans, borrowers can apply online and receive approval within hours, allowing them to address their financial needs without delay.

Additionally, same day payout loans do not require extensive paperwork or credit checks, making them a hassle-free option for those in urgent need of financial assistance.

Another benefit of same day payout loans is the flexibility they offer in terms of repayment. Borrowers can choose a repayment plan that suits their individual financial situation, whether it be weekly, bi-weekly, or monthly installments. This allows for greater control over managing finances and ensures that repayments are manageable.

Furthermore, some lenders may offer the option to extend the loan term if needed, providing borrowers with additional flexibility and peace of mind.

Same day payout loans are accessible to individuals with varying credit profiles, including those with poor credit history or no credit at all. This makes them an inclusive option for those who may struggle to qualify for traditional bank loans due to their credit score.

By offering financial assistance to a wide range of individuals, same day payout loans help bridge the gap between those in need and traditional lending institutions.

Overall, same day payout loans provide a convenient and efficient solution for those facing unexpected financial emergencies. Whether it be a medical bill, car repair, or overdue utility payment, these loans can offer the immediate relief needed to address urgent expenses.

With the benefits of quick access to cash, flexible repayment options, accessibility to all credit profiles, and convenience in times of need, same day payout loans have proven to be a valuable financial tool for many individuals in South Africa.

Same day payout loans in South Africa offer a range of benefits that make them a useful financial product for those in need of quick and convenient access to cash. With their flexible repayment options, accessibility to all credit profiles, and convenience in times of emergencies, these loans provide a valuable solution for individuals facing unforeseen expenses. Consider exploring same day payout loans as a viable option for managing your financial needs effectively.

Same day payout loans are short-term loans that allow borrowers to receive funds on the same day that they apply for the loan. These loans are designed to provide quick and convenient financial assistance to individuals in need of immediate cash.

Eligibility requirements for same day payout loans vary among lenders, but generally, applicants must be South African citizens or residents, have a regular source of income, a valid bank account, and be over the age of 18. Lenders may also consider the applicant's credit history and ability to repay the loan.

The loan amount that can be borrowed with a same day payout loan typically ranges from R500 to R20,000, depending on the lender and the borrower's financial situation. It is important to only borrow what you can afford to repay to avoid falling into further debt.

Once your loan application is approved, funds from a same day payout loan are usually disbursed within a few hours. Some lenders may even offer instant transfers to your bank account, allowing you to access the funds on the same day that you apply.

Interest rates and fees for same day payout loans can vary depending on the lender and the loan amount. It is important to carefully review the terms and conditions of the loan agreement to understand the total cost of borrowing, including any interest rates, fees, and charges.

Yes, some lenders in South Africa offer same day payout loans to individuals with bad credit. These lenders may consider other factors such as income and employment status when assessing loan applications. However, borrowers with bad credit may be subject to higher interest rates and fees.